One of the things that holds people back from budgeting is how difficult it can be. Between bank accounts, spreadsheets, and apps, sometimes keeping track of all those numbers is enough to make you want to quit.

The cash envelope system is a budgeting hack that is simple and effective. It takes the abstract idea of budget categories and makes them tangible and easy to track.

Although the cash envelope system isn’t new, it is a very helpful budget management strategy. If you are considering trying out the cash envelope system, read on to learn the advantages and disadvantages and why you should try this budgeting strategy.

This post may contain affiliate links. Please see the disclosure statement for more information.

What is the Cash Envelope System?

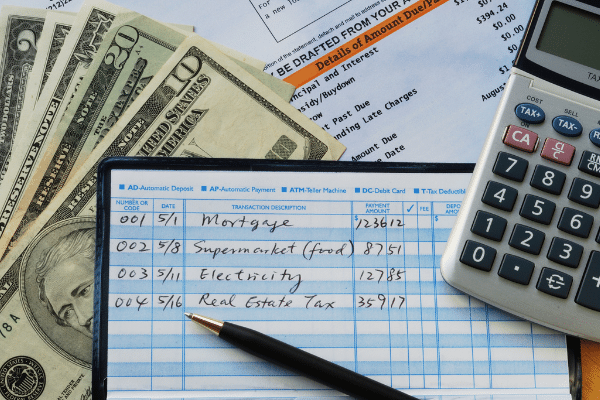

The cash envelope method is a budgeting strategy that allows you to track precisely how much money you have in each budget category by storing your cash in actual, physical envelopes. No more working things out on the back of the envelope using your bank statements and hoping you remembered everything!

It first requires a budget and specific spending categories, which I share more about in this post.

You can use different envelopes to budget your fixed and variable expenses, but most people only use them for variables because that is where they tend to overspend the most.

For example, you don’t need an envelope for your car payment because you probably won’t overspend there.

This budgeting system can be for your entire budget or a category you regularly overspend on. On payday, you cash your check and put the exact amount of money for that particular category(ies) in an envelope.

If your “Eating Out” budget is $40 a month, then you only use what’s in that envelope every time you spend money on restaurant food.

Once you’ve used all $40, you are done eating out until the next payday. This will force you to be strict with your spending and stay on budget.

It’s super easy and straightforward – at the end of the month, if you have money left in an envelope, you can roll it over OR put it into savings.

Why Do People Use The Cash Envelope System?

This system made famous (but not invented by) Dave Ramsey, is a way to gain control of your spending and get out of debt.

People trying to budget their money to live within their means use this type of system because it helps them manage their spending habits and stick to a predetermined amount for each day of the month.

Budgeting money to live within one’s means is a crucial tool for those who are dedicated to living responsibly.

The best part about this type of planning is that it allows you to predict future expenses and see how well you’ve managed your finances and spending habits by the end of each month.

It’s important to remember that budgets go hand-in-hand with common sense.

Because there will be days when emergencies happen (which could result in unexpected expenditures), these issues should always be planned so they don’t have any major impacts.

Recommended: Simple DIY Cash Wallet Dividers (Free Printable)

How the Budget Cash Envelope System Can Stop Overspending.

When using the cash envelopes for budgeting purposes, you are free to spend until it’s gone. There is a bottom to the food bucket. When you reach the bottom, you’re done until the bucket has been refilled with your next paycheck.

Like children, adults also thrive with structure. Spending all willy-nilly without structure and restrictions makes for spontaneous and overly rambunctious spending practices.

Understanding that you only have $100 for beauty this month means you may have to choose between new highlights OR a pedicure…not both. Understanding will stop you from overspending.

You also have to be willing to commit to the process. It doesn’t mean that when you want something, and the cash is gone, you steal from another envelope or pull out the credit or debit card to satisfy your urge for Pad Thai.

Advantages and Disadvantages of the Cash Envelope System

Like any budgeting method, the cash envelope system has pros and cons. The key to sticking to a budget is finding a method that makes sense to you and that you can sustain.

The cash envelope system is simple and easy to use. You know what your budget is for each month. You learn how to live within your means, and you can categorize your spending habits.

6 Advantages Of The Cash Envelope System

The cash envelope budgeting system forces you to be strict! No overspending, no justifying purchases. And if you like visualizing how much money you have left, rather than using a card for everything, get your envelopes ready and head to the bank.

You can see when you are out of money. Literally! Take a glance in an envelope, and you can see that you are out of money in that category or are close to it.

You won’t go over budget because you can’t. There is no wiggle room here. You have the cash to spend on specific things. Unlike online budgeting, the cash envelope system helps you stick to a budget by eliminating the temptation to spend more because you can’t!

It helps you see how realistic your budget is and modify it. If halfway through the month you are out of money for a specific category, or on the flip side, if you have loads of extra cash you aren’t using, then your budget needs to be adjusted. You can easily see what is working and what needs fixing.

Easier to save money. You can only spend that much since you know how much money you have. You can’t lose track throughout the month or forget to see how much is left in your budget; it is all right in front of you.

Plus, you’ll be more cautious with your spending since you can see how much cash you have left. There’s nothing scarier than having a few weeks until the start of your next pay period and no money left to spend.

The cash envelope system makes you aware of your remaining budget and, therefore, a more cautious spender. That caution often results in extra money left over each month that you can then put in your savings account.

The system is flexible. This budgeting tactic can help you manage your spending regardless of age or financial situation. It allows you to track and visualize your daily expenses accurately. You start knowing how much you plan on spending and can physically see how your budgeting is going.

Envelopes reduce the risk of impulse purchases. These budget envelopes require all transactions to be planned ahead of time. That means fewer unbudgeted purchases, out-of-the-blue treats, and spur-of-the-moment trips.

6 Disadvantages of the Cash Envelope System

The cash envelope system comes with its downfalls. If an emergency comes up, and you don’t have your envelopes of cash with you – you’re out of luck (or you just have to go home and get them).

As simple as the budgeting strategy seems, ensure you understand the inconveniences that come with it before you run out and put all your money in labeled envelopes.

It takes time to get cash and separate. The cash envelope system takes time. And unless you have piles of cash lying around, you must go to the bank every month and take out the money you need. Plus, you must separate the money into categories and put them in each envelope.

Not every store takes cash. Over the past year, more stores have transitioned to be “cashless.” If your budget is in physical dollar bills, you might be unable to purchase products from certain stores.

Eliminates the convenience of online shopping. If you don’t have time to run to the grocery store and want to order food online – that won’t work with this budgeting system.

All your grocery money is in an envelope sitting next to you. Do the kids need new school shoes? You can’t order those online, either. You will need to go to the store.

The cash envelope system takes out a level of convenience many of us have gotten used to.

It is hard to separate funds as a couple. It’s hard to have physical cash separated as a couple. Who has all the grocery money? Or the gas money?

Although there are ways around this, like separating your grocery money into two envelopes, the cash envelope system with a couple is more complicated and will take more time.

Harder to track spending. Although it makes it much easier to know how much you’re spending, it makes it much more difficult to know what you spend it on.

Yes, you have your grocery envelope, but how often are you using it? And how much are you spending each time?

Unlike the information automatically stored in your debit account, including the date of purchase and location, the cash envelope system requires you to keep receipts and write things down manually.

Holding cash can be unsafe. It can be risky to carry around a month’s worth of expenditures. You are more vulnerable to theft and/or losing some (or all) of it.

When you lose a credit card, you can quickly cancel it when you realize it is gone. Unfortunately, the same doesn’t apply to an envelope of cash.

How to Start Using the Cash Envelope System

If you’ve read about the pros and cons and decided you want to try the Cash Envelope System, here’s how to implement this strategy.

- Think of your expenditures that need a cash envelope

Using the envelope system for items you tend to overspend on is a good idea. Groceries, restaurants, clothing, gas, and entertainment are good places to start. You can also choose to create a cash envelope for every category in your budget.

- Figure out your budget amount for each category.

Track your spending for a few months using receipts to see how much you spend in each category. If you know you overspend on gifts and impulse buys, you’ll want to set your budget amount lower than your actual spending. The same goes for any category you want to tame your expenses for.

- Create your budget using the amounts you spent/goal amounts

Cut back where necessary and find ways to eliminate spending and increase saving. But, of course, be realistic. If you’re spending $200 a month on groceries, don’t budget to spend $50. You’ll be disappointed and out of money (and food!) fast.

- Get cash from your bank account on payday

Don’t be tempted to purchase online before you pull money out. Get the amount of cash you need from your checking account and in separate envelopes as soon as possible.

- Divide cash into proper envelopes

Simple enough, but the amount of money you’ve budgeted to spend in the appropriate envelope.

- No money=no spending

When you find the envelope for your category empty, stop spending money! Strictly following this rule is very important. Taking money from other categories or using your credit card defeats the purpose of budgeting in the first place.

- Re-evaluate and shift money if needed

It’s important to remember that you can (and should) re-evaluate and shift money in your budget categories. If you constantly lack money for groceries, then budget more.

And if you have leftover money in entertainment, put it into your savings or shift it to a budget category where you need a little more wiggle room.

Can You Use the Cash Envelope System Without Cash?

I have heard people who use the cash envelope system without cash, but I wouldn’t recommend it. There are psychological benefits to holding cash and handing it over to pay for purchases. As a Financial Coach, I would discourage using plastic of any kind.

I can’t imagine not using cash. I owe everything to deciding on a cash system.

Recommended: 21 Best Cash Envelope Wallets {Budget Friendly}

What Cash Envelopes Should I Have?

If you’re a beginner, I highly recommend the following cash envelopes. Pay close attention to the places you tend to overspend the most on and start there.

I no longer use an envelope for gas because I don’t overspend. Instead, I have a specific account with a debit card attached for gas only. It makes life easier, and you can pay at the pump.

- Groceries

- Other food

- Beauty

- Clothes

- Personal Allowances

- Toiletries (or, in my case, Target)

Once you have been using this system for a while, you will find other areas for which you like having cash. Kids, for example, and all the fun that goes along with their lives could benefit from a few cash envelopes.

Where To Keep Your Cash

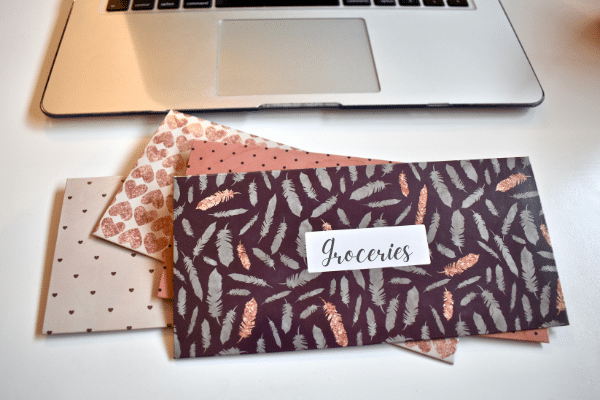

Some people use the actual envelopes described above. They will grab their grocery envelope and use it when shopping.

I have seen people who use a Filofax binder zip around planner wallets with pouches to organize their cash.

Others will go to the Dollar Tree and grab a coupon organizer to keep with them as needed. Everyone will find a system that works best for them.

I do not use envelopes in the most common sense of the word. Instead of those basic A6 brown envelope cash envelopes, I went with something a little more special.

Even though it is based on the cash envelope theory, it doesn’t work for me.

A few people have created these cash envelope wallets that are affordable and fantastic.

How Many Envelopes Should I Have?

Starting with 3-5 is a great way to start in the beginning using the envelope budgeting method. The last thing you want to do is overwhelm yourself. Stick with the basics and then add more as you see fit.

There is also an option of the cash envelope wallet. This style of wallet will help you be more organized and spend less time fumbling with envelopes at the checkout.

Final Thoughts On Whether The Cash Envelope System Works…

Budgeting is hard. In a magical, perfect world, it would be simple to save money and a breeze to lose weight, but the reality is budgeting will be a process with a learning curve.

Although the cash envelope system has difficulties, having tangible money in specific categories forces you to be strict and stick to your budget.

If you don’t want to drive to the bank every week (or every month) and don’t want to deal with the hassle of sorting your money, the cash envelope system might not be for you.

But if you want a visual, hands-on approach to staying on budget, the cash envelope system might be the solution you’ve been waiting for.

If you’re looking for a way to get your spending under control and save money, the cash envelope system may be what you need.

The advantages of this system are that it forces discipline on how much is spent each week and offers an easy mental separation between income and outflow.

Some disadvantages include not having access to all of one’s funds immediately if something urgent arises or forgetting where specific envelopes are located (in which case they must be counted).

19 Advantages and Benefits of Budgeting Your Money

19 Advantages and Benefits of Budgeting Your Money