Managing personal finances can be a challenging task, especially when it comes to paying bills. Juggling numerous financial obligations within a limited budget often leads to stress and financial strain.

However, a practical and effective method can help you regain control over your finances and alleviate some of the burden: the Half Payment Budget Method. By implementing this strategy and depending on your financial situation, you can make significant strides toward paying your bills in a more structured and organized manner.

What Is The Half Payment Budget Method?

The Half-Payment Method is a straightforward approach that involves separating your monthly bills into two equal parts and paying each half at different points during the month.

By dividing your bill payments, you can better manage your cash flow and avoid experiencing a significant financial hit all at once.

This method is particularly useful if you receive paychecks twice a month or biweekly, as it allows you to align your bill payments with your income streams more effectively.

Implementing the Half Payment Budget Method requires careful planning and organization. Begin by creating a comprehensive list of all your recurring monthly bills, including utilities, rent or mortgage payments, insurance premiums, and other financial obligations.

Once you have identified these expenses, calculate the total amount and divide it into two halves. Assign each half to a different paycheck period, ensuring that you allocate the necessary funds accordingly.

Not only does this method provide a structured approach to managing your bills, but it also helps you avoid late payment fees and potential penalties. By breaking down your expenses into manageable portions, you can maintain better control over your overall budget, allowing for more flexibility and peace of mind.

We create a budget for everything we want and must pay for within the month. However, each paycheck has its very own budget. We assign each payment within the month to the paycheck that coincides with what we get every other month. It is also known as the half-payment budgeting method, too.

What Is A Zero-Based Budget Plan?

I am sure you have heard this before. A budget is just a plan for your money. It is a way to be aware and present how you handle your money, an economic blueprint. A way to control how much you save, how much you spend, and where to designate the rest.

I love budgets! I love being organized and knowing where my money is going. I like knowing these things, and the advantages of budgeting are great for me. It keeps me calm and sane. I may or may not be a control freak. And knowing I am in control of our money makes me less stressed.

Having a plan for your money must work for you. Whether on paper in a budget binder, an app, or a spreadsheet, it must fit into your life.

Three-quarters of Americans are one disaster away from financial tragedy.

Essentially, a zero-based budget is a budget that has no money left when you finish deciding where it goes. Giving every dollar a place in the budget enables complete control over your cash.

For example, If your budget is an entire month out and you have $180 left over, you cannot just let it sit without a name. Even if you name that $180 miscellaneous or cushion, it has a name and a purpose. It will disappear if it doesn’t have a name and purpose.

A zero-based budget is your end game. Your goal in any budget gives you power over your money and spending.

Once you have a budget, you will see where your money and shouldn’t be going. It allows you to make tweaks and changes where they need to be. You may even feel like you got a raise!!

Who Needs A Budget?

Ummm…just about everyone!

If you have bills and responsibilities, you need a budget. If you have goals and dreams, you also need a budget.

If you do not have a budget, I’m sure it isn’t because you don’t know how. I am sure it’s emotional, and everyone has an excuse for not having one. There are so many places to learn HOW to make a budget. It’s time-consuming and restrictive. It’s too depressing to see all this money disappear, and really, it’s just not fun.

Getting through the emotional aspect is a great first step and probably the biggest obstacle. You really need to be in the right money mindset to start the budget process.

Advantages Of Knowing Where Your Money Is Going

Here are some great reasons to have a budget!

- To know your spending habits, how much money you have, and where it’s going.

- Control over your money to become debt-free.

- You are planning for your future.

- You are saving money for a beach house or any other big dream.

- Less money, stress, and fights.

- Permission to have some fun without guilt.

- You are feeling like you got a raise with all the money you have found going to waste.

The Problem With Traditional Monthly Budgeting

It’s too much time to predict. There are four weeks (sometimes five) to accommodate. Yes, if we got paid once per month, we could plan for all of our expenses for the entire month. But why not break it down and plan for the times when you do have your money?

Having all your sinking funds fully funded is excellent, but something always comes up. You do not have all of your money at the start of the month, and you really can’t know what will happen during that month. I find it so much easier to manage than an entire month.

Looking at the entire month can be intimidating and overwhelming, taking a toll on emotions. A budget is supposed to relieve stress, not add to it. Taking smaller bites can allow you to be that much more in control.

Living Paycheck To Paycheck On Purpose

Most see living paycheck to paycheck as a negative thing, which is stereotypical. I propose trying it all little differently. Live paycheck to paycheck on purpose. Design your financial life around the way you get paid.

We get paid every other week, so we budget biweekly.

Because we like to focus on short-term and long-term goals, budgeting bi-weekly allows us to look at our short-term financial goals in these smaller chunks without getting overwhelmed and giving us control over our money.

What does it mean to live paycheck to paycheck?

It means that there is no cushion for errors or emergencies. No money is left in their account when the next paycheck has cont. It has all been spent.

According to Forbes, Career Builder showed some pretty upsetting statistics from their survey in 2017.

- Nearly one in 10 workers making $100,000+ live paycheck to paycheck

- More than 1 in 4 workers do not set aside any savings each month

- Nearly 3 in 4 workers say they are in debt – and more than half think they always will be

- More than half of minimum wage workers say they have to work more than one job to make ends meet

- 28% of workers making $50,000-$99,999 usually or continuously live paycheck to paycheck

- 70% are in debt

- 32% of the nearly 3,500 full-time workers surveyed use a budget, and only 56% save $100 or less monthly.

However, this is NOT what living paycheck to paycheck means to us!

Is This The Same As The Half Payment Method?

We live paycheck to paycheck on purpose because this is what works best for us. I can add to my sinking funds, see what needs to be paid each pay period or biweekly and plan accordingly for things that might come up within those two weeks!

We take half of our expenses and set them aside for the month. You could pay half your costs at the beginning of the month and the other half at the end.

So, instead of a monthly budget, we have a biweekly or half-payment budget method. And the best tools for this are a calendar, a pen, and a stack of bills.

How Do We Budget A Bi-Weekly Paycheck Cycle?

Grab all those bills or open up the apps to find out the due dates of your monthly expenses and the average amount due each month. Sometimes they are fixed amounts where the payment is the same each month. Consider your recurring bills: mortgage, car payment, or cable bills. They are always the same monthly payments: $1200 and $125 every month.

Other bills, like electricity, might be variable expenses from month to month, so finding an average of that bill for the year may take a little extra time.

Also, if you find too many with a due date at the beginning of the month, sometimes companies will change your due dates. Just call your service provider and ask. This will allow you a little more balance in your budget.

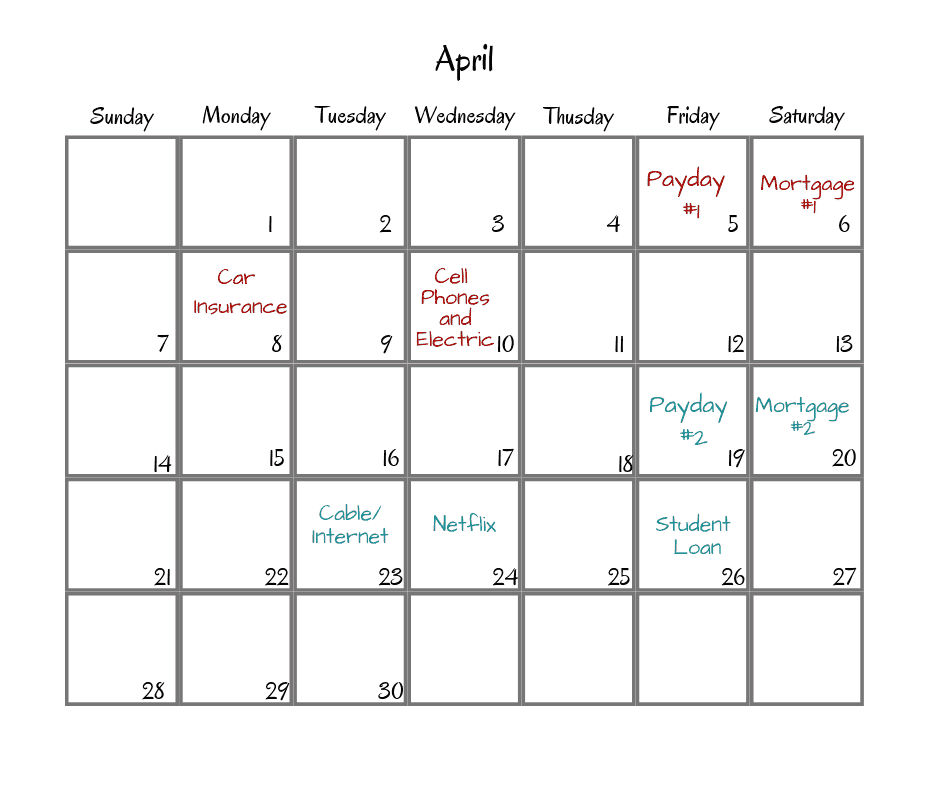

Let me show you an example calendar.

For April, We have these bills:

- Mortgage: $1200

- Cable/Internet:$125

- Cell Phone: $75

- Car Insurance: $100

- Electric: $120

- Netflix: $10

- Student Loan: $375

Our monthly income is $4400 per month or $2200 each paycheck.

As you can see, bigger bills are cut in half. Sometimes your mortgage company will allow you to make multiple monthly payments or partial payments. So instead of waiting until the end of the month and making a full payment, you have them take half payments out of your bank account twice a month. It’s a great way also to be able to make two more extra payments per year.

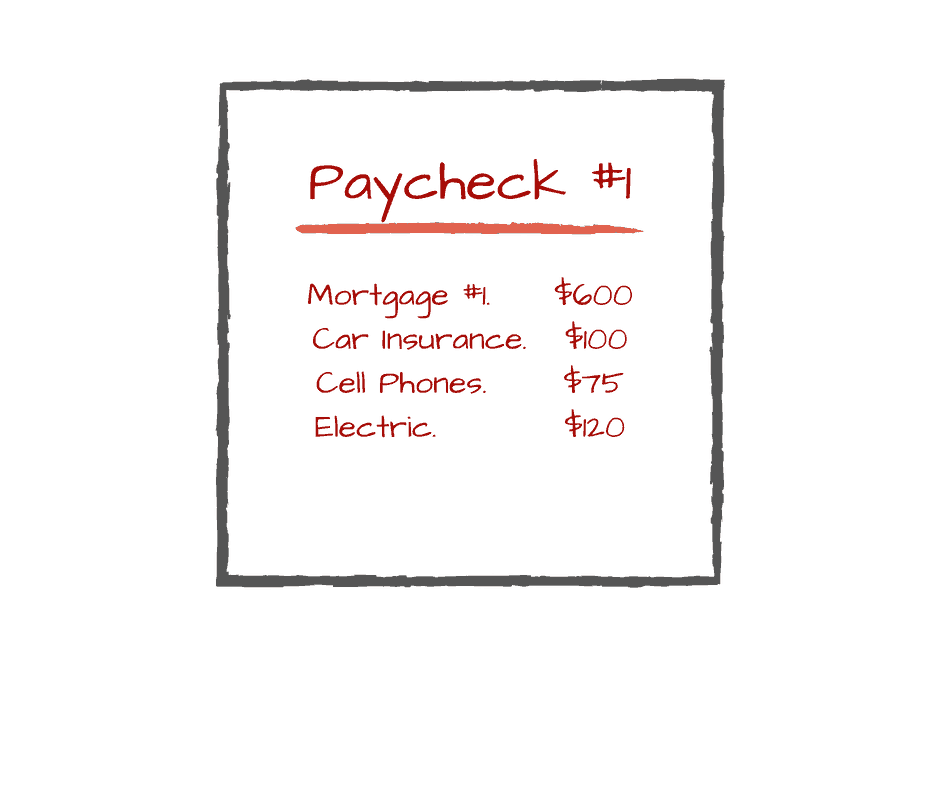

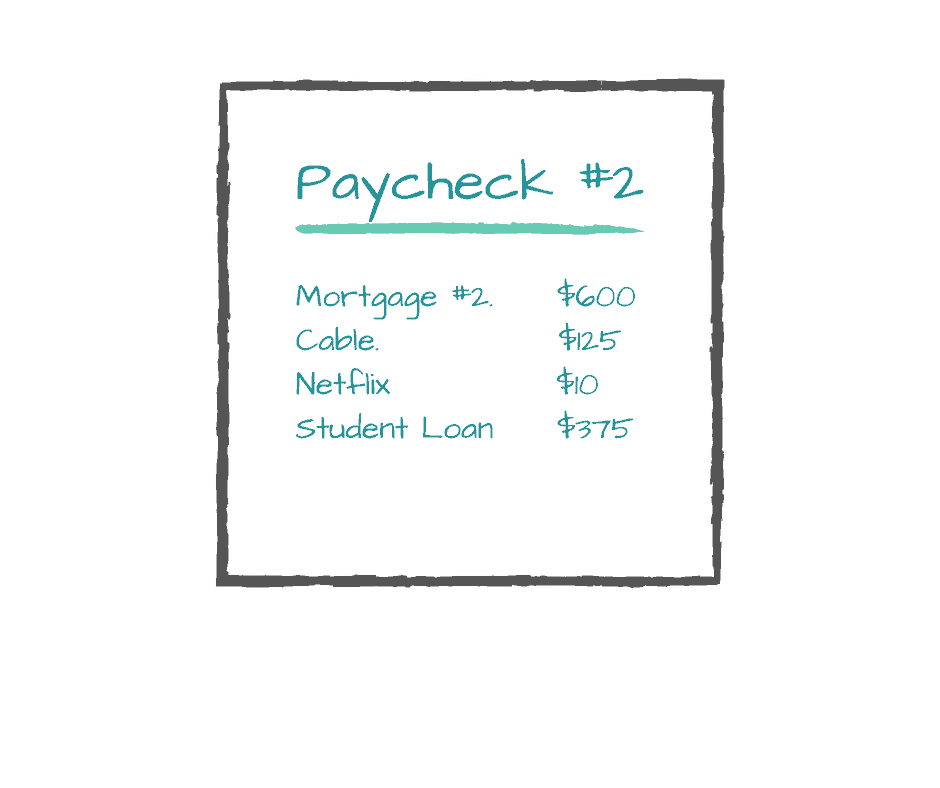

Looking at the calendar, you can see the dates when each of our bills is due. Assigning each of these to a paycheck, we come out with a list of bills set to each paycheck as follows:

Paycheck #1 in the first half of the month totals $895, meaning $1110 disposable income is left for credit card debt repayment, sinking funds, groceries, an emergency fund, and possibly some extra money for investing or building a savings account. It’s also a good idea to get one month ahead. That extra money (or leftover money)and reserving it in a separate checking account for next month will help you do that.

Paycheck #2, the second half of the month, has a little less left over to do the same. I would consider paying off that student loan before investing.

The half payment budgeting method is the best way to make sure you have enough money to pay your regular monthly bills and have enough for discretionary spending, too.

Where To Keep Track Of Your Bi-Weekly Budget?

My favorite place to keep my budget is in my budget binder. I love this thing. If there was an emergency and we had to leave the house, I would grab this binder, the baby, and wedding photo albums. That is how much it means to me.

Some prefer to budget using spreadsheets or computer-based systems. These are great when you’re already on the computer anyway.

Many would instead use an app or computer program, which is just as effective. You can use the calendar on your phone with Every Dollar, Mint (or any other app you enjoy).

Have you thought about living paycheck to paycheck on purpose? How do you budget? Is there another way besides biweekly or monthly that you have come up with to take control of your money?

How To Budget Irregular Income With The Half Payment Method

Budgeting irregular income with the Half Payment Budget Method requires a flexible approach. Start by tracking your average monthly net income over a year and determine your lowest earning month. Calculate your essential expenses, such as rent, utilities, and groceries.

Subtract these expenses from your lowest monthly income to determine your available funds. Divide this amount into two equal parts and allocate each half to a different pay period. During higher earning months, set aside the surplus to cover any shortfalls during lower earning months.

This method ensures consistent bill payments and helps you navigate the challenges of irregular income with greater financial stability.

Final Thoughts On The Half Payment Budget Method

The Half Payment Budget Method is a valuable tool for anyone seeking to take control of their bill payments, improve their financial situation, and find financial freedom.

By dividing bills into two equal parts and strategically allocating payments throughout the month, this method provides a structured and manageable approach to handling financial obligations.

Not only does it alleviate the stress of lump-sum payments, but it also helps to maintain better control over your overall budget. With careful planning and organization, you can avoid late fees, penalties, and the burden of overwhelming bills.

Implementing the Half Payment Budget Method empowers you to regain financial stability, reduce stress, and work towards a more secure future.

How To Find Inspiration On Your Debt Free Journey

How To Find Inspiration On Your Debt Free Journey

Erica

Hello,

My husband gets paid every Friday and I get paid once a month. How would you recommend we go about budgeting for that? Currently, I budget most of our bills using the weekly paycheck and anything that is due around the same time or after the monthly paycheck, I use it to pay with. I also noticed you had mortgage #1 and mortgage #2, are those two separate mortgages or just one that you split into two payments so it wasn’t one big one?

Sara

Hi Erica! I break down our bills into 2 week segments. Anything due at the beginning of the month gets paid the last paycheck of the previous month. I would add your monthly paycheck in and designate specific things that your check would cover. maybe your check would be for groceries for the month and the internet, for example. Mortgage is broken down into two paychecks because it’s so big and also because that’s how we paid it with our bank. They gave us a better interest rate if we paid it twice a month and automatically out of our account.

Paula Garcia

Hi Sara!

It’s good to know I’m doing it right as single mom! I have been breaking down my bills for the longest time. I don’t have any other way, with my 2 boys..

Thank you!

Sara

Thanks for reading. Keep up the good work! 🙂

variety with nandy

I am confused, so you mean like someone who gets a monthly check should like divide it bi weekly to pay for bills and so on?

Or how can a person thats get paid monthly go about with this budget.

I really love Nd enjoyed reading this,definately want to start budgeting this way.

Maryam

Hi

I started doing this is August and so far I’ve paid off over $1000 in credit card debt. I’m hoping to tackle my student loans next year

Sara

This is FANTASTIC! Great job!!

Maria

Sarah my husband gets paid weekly and I get paid bi weekly how would this work? So that makes atleast 2 weeks out of the mo th both our checks are together.

Sara

Assigning specific bills to each paycheck would be the easiest way. Big bills like housing would be split up out of each pay for each person.

Penny Tuttle

I get paid on the 15th and 30th of every month. My husband gets pause every other Wednesday (starting this coming Wednesday). How would you suggest us to set up a budget? Our mortgage and car payment are both due on the 16th.

Sara

I would suggest assigning bills to each paycheck. Your mortgage is probably a big one that needs to be divided into multiple parts. We had ours set up to auto-withdraw and pay twice a month. It was the easiest for us.

Robin

Hi Sara,

Gm this is such good information. I would like to start using this method. I’m sure it will be helpful. How does this work when I’m already behind on my bills and there are more bills than money to start with? What would you suggest?

Sara

You have to find a way to get caught up on your bills first, before anything. Try this article: https://frozenpennies.com/how-to-budget-when-you-are-behind-on-bills/

Thanks for reading!

Patti

Sara, I would love to try this method. My husband and I both get paid bi-weekly, but on alternating weeks. So, I get paid today and he gets paid next Friday. Right now, we are way behind on our debt payments, but our ‘important’ payments are current. How do you go about assigning money to regular monthly payments, and irregular debt i.e- hospital bills, credit cards, and other stuff like kids’ sports? Thank you.

Sara

I would start with an envelope system. Even if its not in cash, create a virtual envelope system to set a budget for everyday items like food, housing, electric, car. Be realistic and selfish with your money and assign all bills a date to get paid. I suggest stopping all discretionary spending until you’re caught up. I do offer paid coaching if thats an option for you.

Martha

I have done this for years. It helps to be sure to put away the savings from the paycheck that doesn’t align with all the bills.

Cynthia

Good information I was confused on how to start. But you all made it easy to understand I will be using these method ♥️

Juanita

Just reading this gave me anxiety! NO JOKE! But I’m definitely gonna try it. I’ll be getting paid every 2 weeks at my new job and the hubby gets paid monthly. I need to get my $$ under control!!

Megan

Another benefit of paying all bills with interest (mortgage, car note, credit cards, loans, etc) twice a month is that it doesn’t allow as much time for interest to accrue between payments!