Dave Ramsey, the leader in debt freedom at Financial Peace University, has created Dave Ramsey’s 7 baby steps to get out of debt and build wealth.

He is the author of The Total Money Makeover and many others. He has a podcast, a radio show, a YouTube channel, and a “cult following of sorts.”

He has helped thousands and thousands of people get out of debt.

This post may contain affiliates. Please see my disclosure for more information.

Table of Contents

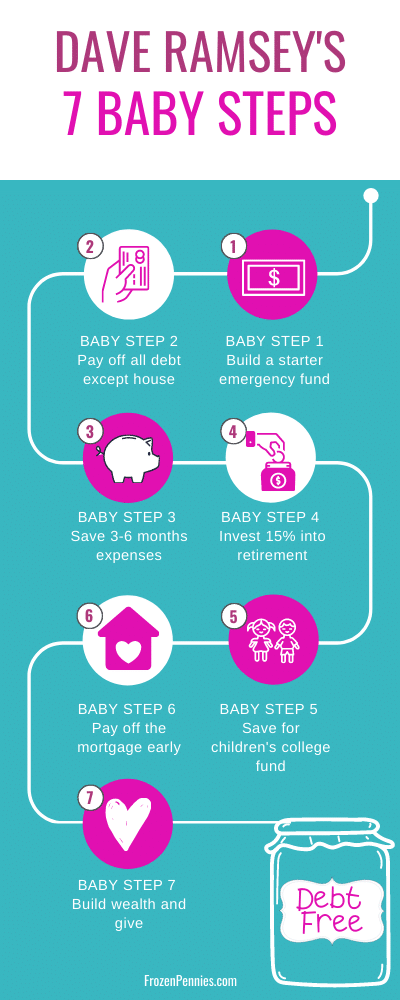

What are the 7 Baby Steps to Financial Freedom?

Dave Ramsey’s Baby Steps is a personal finance tactic used to be debt-free, set financial goals, build a legacy, and live your best life. He started Financial Peace, a class designed to teach these principles, because he knew what it was like to be completely broke. He made millions and then lost it all due to what he calls his “stupid tax.”

Dave makes the steps easy to follow. Whether you take Financial Peace University through a local church or online or skip it and buy Total Money Makeover on Amazon, the seven baby steps are the bread that holds the butter.

Seven Baby Steps

- Baby Step 1: Save $1,000 for Your Starter Emergency Fund

- Baby Step 2: Pay Off All Debt Except the House

- Baby Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

- Baby Step 4: Invest 15% of Your Household Income in Retirement

- Baby Step 5: Save for Your Children’s College Fund

- Baby Step 6: Pay Off Your Home Early

- Baby Step 7: Build Wealth and Give

Baby Step 1: Save $1,000 for Your Starter Emergency Fund

It’s going to rain. We all know things happen. Being able to have a little bit of money set aside when something happens brings a measure of peace to our lives.

Getting out ahead of an emergency is an excellent way to prepare yourself and let it go. Having that small safety net will let you focus on the real task at hand.

You only need $1,000 right now. More will come in baby step three.

How do I get the money to fund Baby Step 1?

There are a lot of great ideas for an emergency fund account in baby step one. You want to create this fund as fast as possible and get the momentum for debt freedom. The best way to do this is to sell stuff.

Take a look around your house, yard, and garage. I’m sure there are plenty of things that you aren’t using anymore. Have a garage sale, list them on Facebook Marketplace, or sell them on Craig’s list.

Where do I keep my emergency fund?

You can keep it in a savings account where you do your regular banking. You can also try a different bank, which would make it a little more challenging to get to – both a good and a bad thing.

Many choose to earn interest on it through online savings like Capital One 360. This is where ours is, but it’s not the baby emergency fund anymore.

I heard once of a lady who framed the 10 $100 bills and hung them in her closet behind the clothes. She wrote on it, “In case of emergency, break the glass.”

Some strongly disciplined people will keep it in a safe in their home.

No matter where you put it, remember…. it’s only for emergencies.

Baby Step 2: Pay Off All Debt Except the House

The best way to tackle all this debt is with the Debt Snowball Method. List all debts from smallest to largest and start tackling them in that order.

No need to pay attention to interest rates as it’s not important at this stage of the game.

The purpose is to find those quick wins in baby step two. As you did with Dave’s baby step one, the first step is to cut costs and find things to sell to throw at this debt.

Save money on groceries, slash utility bills, and use a cash-only system.

Find ways to cut back or cut out whatever you need to to get gazelle intense.

Cut up credit cards and eliminate credit card debt and student loan debt. Don’t be stuck in the cycle of making minimum payments and seeing those highest interest rates eat your money.

This is the time to live on rice and beans. Cut spending down to the simplest and cheapest alternatives.

Baby Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

After the debt is completely paid off and you do your debt-free scream (privately, on Facebook, in your yard, or you travel to the Dave Ramsey show), it is time to build up that emergency fund in Baby Step 3 for those unexpected expenses or if you faced something like job loss.

I lean more toward the six months’ worth for my security, but this will depend on your thoughts and feelings.

Because you went through all of your expenses and cut everything that you could to get out of debt, you should have a good idea of how much your costs are. It’s time to do some quick math and devise a plan.

Now, take that same drive and motivation and fuel that emergency fund so you can move on to baby step 4.

Baby step 3b: Save for a house

If you do not yet own a house and would like to, this is the time to start saving for a down payment and closing costs. Real estate is also a solid investment for later in your financial journey.

If you’re feeling motivated and ambitious, you could save and pay cash for a house. That’s a little more complicated with a lot more patience. I’ve seen people do it, and it’s a lot of fun to watch.

Baby Step 4: Invest 15% of Your Household Income in Retirement

If your company offers a 401K, that will make this baby step four easy to do. Just head to your human resource office or log on to your company investment page to increase the contribution to your retirement accounts.

If your company offers you an employer match in your 401k, that’s free money. It would be best if you were doing anything to get as much of that as possible.

If you are late to the investment game, you might have to go higher than 15%. We were, and I am finding my way up to 20% for my husband. He only has five years until retirement – I want him to retire in two.

If you don’t have this system at work, I suggest sitting down with a financial advisor. You can find a trusted one at Dave Ramsey’s Smart Vestor Pro site.

Depending on your career, There are other ways to contribute to a retirement fund. However you decide to do that, just do it.

Baby Step 5: Save for Your

Children’s College Fund

There are some mixed reviews on whether you should save for a college education for your children or if that’s the child’s responsibility.

Giving them a leg up on life is good if you can swing it with education savings accounts.

The main goal is to prevent them from taking out loans to pay for college. The last thing you should want is for your child to start their adult life with a mountain of debt.

I know people in their 30s that are struggling to buy a house because their student loan payments are as much as a mortgage. And they have YEARS left.

If you can help your young adults and shoulder the burden, by all means, you should. However, if you are coming into Dave’s teachings and they are teenagers, you just have to do your best.

The responsibility should also be on the student. Taking classes at a community college, getting a job, or applying for scholarships will all help disperse the need for student loans.

If your child is still young, check with your state and financial advisors on the best options for college savings – like a 529 savings plan.

We were able to get the school paid for through the Excelsior Scholarship in New York State.

As long as the criteria are met, our son can go to school at minimum out-of-pocket costs, which means we didn’t need baby step five.

Baby Step 6: Pay Off Your Home Early

Paying off your home has fantastic psychological as well as financial benefits to it. It’s incredible to know that my house is mine and nobody can take it away for lack of a mortgage payment.

Your house payment is the largest purchase you will probably ever make. Spending most of your life paying for it doesn’t sound like too much fun.

Paying it off as soon as possible gives you the financial independence to fulfill all the other dreams you might have.

After all the debt is paid off, consider how much “extra” money you will have to throw at the mortgage. It will be paid off in no time!

Many people will do baby steps 4, 5, and 6 simultaneously. You can do whatever you feel is the right thing to do, but pay off your mortgage.

Baby Step 7: Build Wealth and Give

“You know what people with no debt can do? Anything they want!” Dave Ramsey.

There is fun and freedom here. It’s where you can spend the rest of your life and live happily ever after—building wealth and giving to others. Enjoying financial stability and giving as much money as you want to causes you believe in.

Generosity and gratitude for what you have will give you the positivity to feel good about how far you’ve come. Be proud of yourself. It’s a HUGE accomplishment. The last one of Dave Ramsey’s 7 baby steps is the best.

Final Thoughts on Dave Ramsey 7 Baby Steps

When someone asks me, “What are the 7 baby steps to financial peace,” I always send them the link to the Total Money Makeover. Without Dave Ramsey 7 baby steps, I would not be where I am today. I give this book away to everyone I can.

Finding your way through the cobwebs and stress of debt can be daunting and complicated. These simple steps make it a little bit easier.

Gazelle Intensity: Is Dave Ramsey’s Debt Idea Too Much?

Gazelle Intensity: Is Dave Ramsey’s Debt Idea Too Much?