The idea of having your place to call home is thrilling. But when you have the fixed cost of rent taking a big portion of your budget, saving up for a down payment might seem impossible.

Read on to find out simple things you can do to save money for a down payment while renting.

What is involved when buying a house?

When it comes to purchasing a home, it is important to know exactly what you are getting into. Unfortunately, it isn’t as simple as a monthly mortgage payment. Some of the other costs that come with purchasing a home include:

Insurance: Lenders need proof of home insurance before closing on a home so they know their investment in your home is protected. The cost of homeowners insurance is dependent on many variables, including the value of your home, your location, and the potential for catastrophic loss (tornados, hurricanes, earthquakes, etc).

In 2017 (the most recent data available), the average annual cost of homeowners insurance was $1,211. You can call your insurance agent for an estimate as long as you have detailed information about the home you are considering purchasing.

The first year of homeowners insurance is generally paid in full at closing as part of your closing costs (see below), but you also need to figure this amount into your annual budget going forward.

Check out Lemonade for insurance. They deduct a flat rate for your insurance and then give the rest to a charity of your choice. It’s a great company.

Down payment: A down payment of at least 20% of the purchase price is standard. If you are looking at a home with a sale price of $200,000, you will need to have $40,000 to put down.

Take heart if this seems overwhelming! Some lenders have no or low down payment loans available. However, if you can save up a 20% payment, that will position you for the best possible interest rates and more affordable monthly payments.

Closing costs: This is another part of home buying that many first-time home buyers don’t know about or plan for. Closing costs are the fees and costs you pay in addition to your down payment.

Closing costs might include loan origination fees, the first year of homeowners insurance, property taxes (usually six months’ worth), escrow fee, home appraisal, and Private Mortgage Insurance (if you can’t afford a 20% down payment).

These usually add up to approximately 3-5% of your loan amount.

Additional expenses: Don’t forget to include the cost of moving (trucks, boxes, tape, workers, time off of work) as well as any repairs or improvements that you want to be done before moving in (painting, carpet cleaning, or replacement, etc).

Consider other expenses you’ll have once you move in:

When considering owning your home, don’t forget that there will be additional costs once you move INTO the home.

Updates: If you want to update your home to include new fixtures, countertops, and/or flooring, consider the costs of getting these updates done before making an offer on the house. Think about what updates you can live without and which ones are dealbreakers.

Repairs: There can be repair costs with older homes, including electrical, roofing, and plumbing. Home inspectors should catch these costly expenses during a standard home inspection. You may be able to negotiate the repairs during the home-buying process.

New furniture: There’s nothing like moving into a new space and realizing you have nowhere to sit! If you are moving into a new home, consider the furniture you will need to make it liveable and save up money for the extras.

What are your spending habits like today?

If you are feeling overwhelmed and discouraged looking at the costs of buying a home, take a minute to think deeply about your current spending habits. There is usually room to “tighten our belts” and make homeownership possible instead of a dream. Consider the following:

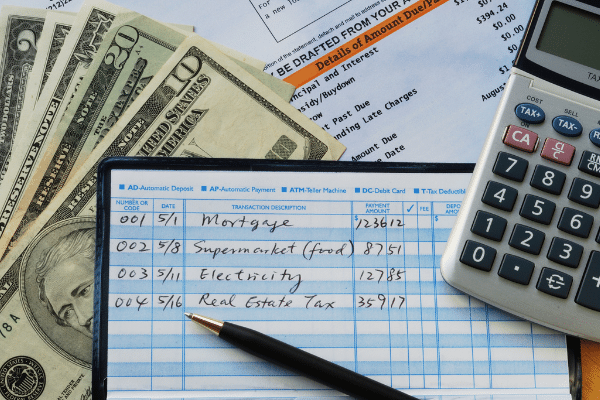

Do you have a budget? Budgeting is an integral part of becoming a homeowner. If you spend below your income, you can slowly but surely build up savings that will cover the costs of owning a home, including your down payment and closing costs.

Are you living below your means? As you create or evaluate your budget, do everything possible to live below your means. Look carefully at your budgeted items to see if you can decrease costs and increase your savings.

Consider a cash envelope system to manage money better.

Consider cutting or paring down non-essential things like cable. Try programs like Philo for a fraction of the cost.

Do more home cooking and meal planning to save on your food budget.

Do you have an emergency fund? As you evaluate your spending habits, one area that will help keep your budget healthy is to establish and maintain an emergency fund. When unexpected expenses occur, like a car repair or medical bill, an emergency fund can help you stay on track.

Most experts recommend a minimum $1000 emergency fund. Growing this emergency fund to 3-6 months of monthly expenses is an even more valuable budget cushion.

How much house can you afford? You should carefully consider the amount of mortgage you can afford. A good rule of thumb is that your mortgage payment shouldn’t be more than 28% of your pre-tax monthly income.

Multiply your monthly income by 28 and divide by 100 to find this number. Some financial experts recommend staying within the 25-28% rate.

After you figure out your target monthly mortgage amount, plug it into your normal budget in place of your rent. If your mortgage amount exceeds your current rent, you must adjust other budget line items.

It isn’t fun to be “house poor,” so consider your entire budget when determining how much house you can afford.

Do you have debt? When looking at your current spending habits, take a very close look at your debt. Not only can debt impact your interest rate and mortgage amount, but it can also make the difference between a lender giving you a loan or not. If you have debt, paying it down or eliminating it might be a good idea before purchasing your first home.

Set realistic goals.

We’ve discussed all the costs of purchasing your own home and taken a closer look at current spending. So what is the next step towards saving for a home while paying rent?

How fast can you save for a downpayment?

You can create a timeline for homeownership by seeing how quickly you can save up your down payment and closing costs. Snowball those savings by:

Saving money on groceries: Meal planning, coupon cutting, and making more food from scratch can add to significant savings on your grocery bill.

Going an unconventional way, like the $5 Meal Plan, will save money, and plan menus keeping you on budget.

Consider money-saving apps: Apps like Ibotta or Rakuten will save you money, and those pennies will add up.

Sell stuff: Look around your apartment or home and find things you cannot use and can sell. Even small sales will push you faster toward buying a home!

Start a side hustle: A side hustle is an amazing way to amass money quickly. Many options are available for part-time work, including driving for Door Dash, Uber, or Lyft, teaching English as a second language online, starting a craft business, or doing transcription work. Think about the skills you have that you could turn into a money-making side hustle.

Cut down on utilities: Monthly utility bills can take a big bite of our income. Consider reducing your utilities, including lowering your thermostat, using energy-efficient light bulbs, and using window coverings that keep heat in (or out!). Many local utility companies will come to your house and do an energy efficiency check for a nominal fee.

Cut out cable: With all of the options for streaming shows, cutting cable isn’t as painful as it once was. Cutting out cable and choosing one or two streaming services can save you a lot of money toward your new home.

Eat at home: Eating out is much more expensive than home-cooked meals. Bring your lunch to work, plan out your meals, and eat at home to save on your grocery and dining expenses.

Ways to save money on rent

Now that you’ve tightened your budget to squeeze out every penny possible, it is also good to contemplate ways to save money on rent. If, between living costs and rent, you have no room to save money, you might want to consider:

Living with family: Parents/relatives who have been through the process of buying their first home might be thrilled to help you out by sharing their home. Offer to pay rent, help with other expenses, and mark a specific end date so it doesn’t strain your relationship.

Get a roommate: If you have space, getting a roommate to offset your rental costs is an amazing resource for saving money. Make sure that it isn’t against your rental contract and establish rules before having someone move in.

Move: You can also look for a cheaper place to rent while saving money for a house. It might not be your dream situation, but it is a means to a better end.

Offer to do work for the landlord: Ask your landlord if you can do home improvement or other work to get a reduction in your monthly rent. Yard work and property improvements are a great place to start.

Give up amenities like garages or storage: You can sometimes lower your rent by giving up your parking garage or storage space. Think about all of the amenities included in your rental costs. Look for things that might be negotiable.

Do some research

If you are wondering how to save money for a down payment while renting, one of the most important things you can do is do upfront research so that you fully understand the process and costs involved.

It might seem intimidating and overwhelming, but you are not the first (or the last!) person to panic at the thought of all you need to do to be ready. There are workarounds that can help speed up the homebuying process including:

First-time buyer programs: Talk to your lender about first-time homebuyer programs. There are loans backed by various government entities that allow you to purchase with less money down or less than stellar credit.

Nerd Wallet has a great resource for first-time buyer programs by state.

There are also homebuyer programs to help Native Americans, veterans, people purchasing rural properties, law enforcement officers, firefighters, emergency medical technicians, and teachers.

Be sure to talk to your lender about these and other grants that might be available.

PMI: Saving a 20% down payment can be a stretch for even the budget-conscious renter. Private Mortgage Insurance (PMI) is a workaround for people who can’t swing a big down payment.

PMI is an insurance policy that protects the lender if you can’t pay your mortgage. If you pay less than 20% down, your PMI is a monthly fee that can be rolled into your mortgage cost.

Even though it is an additional cost at the beginning of your homeownership journey, it can help you to build equity immediately instead of waiting 10-20 years to save enough for a down payment.

Typically, PMI will cost you between $30-70 monthly for every $100,000 you borrow for your mortgage.

Final Thoughts on How to Save for a House Down Payment While Renting

Saving money for a down payment while renting IS possible. Hundreds of thousands of people do it every year. By understanding the process and costs, tightening your budget, setting realistic goals, and looking into helpful homebuyer programs, you can be well on your way to owning your first home.

What is the 30 Day Rule for Saving Money?

What is the 30 Day Rule for Saving Money?