We all have bills that we need to pay. But how do you keep track of your bills each month? Many people use a budget binder, and they are a great way to track personal finances, but this isn’t for everyone.

I love my budget binder, but I don’t want to spend all day in there. I have things to do! How can we make it easier on ourselves?

If you’re a mom, then it’s likely that your days are full of juggling the needs of your family and managing the household. The last thing you want to worry about is how to keep track of all your bills each month. Luckily for you, there are some simple steps you can take to make this process easier for yourself.

In this blog post, we’ll discuss five easy ways to help you stay organized with monthly bills tracking so that when it comes time to pay them, they won’t be one more thing on your plate!

Get it done quickly and get on with the rest of your life.

Pick The Day And Time

I pay my bills and review my budget every other Friday. This is when my husband gets paid, and because that’s when I’ve always done it. It works, so I’m sticking to it. I grab my coffee and head up to my office, where I pull up my online bank account and get to work.

I’m done about the same time I finish a cup of coffee—about 30 minutes.

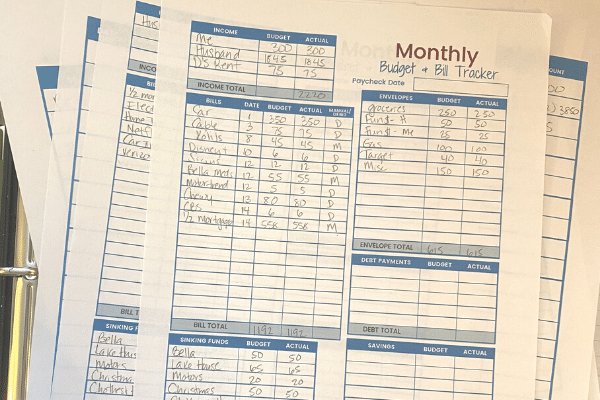

Fill Out A Budget Binder Or Online Spreadsheet

If you’re brand-spanking new to this idea, decide how you want to keep track of your bills and your monthly payments.

There are many different methods to consider trying, and the first step is to find one that you feel is among the easiest ways to set up. Some people choose the good old-fashioned pencil and paper technique. But if you’re hip and cool, you should head straight to a budgeting app like Mint or Mvelopes. Others might prefer a spreadsheet you can keep somewhere, like your Google Drive or iCloud account.

I love my own Penny Planner. After spending a LOT of time playing with other concepts and spending way too much money on other planners and binders, I created one that I (and others) like best to manage my monthly budget.

This works best to not only keep track of every bill and when it’s due but also of how much money you have coming in every month, as well as the amount of money owed out to each monthly bill- which should now reflect your current situation.

Pay All Bills

After everything is filled in each month and all the numbers balance, I pay the bills. These are all bills that fall into that 2-week time frame.

Now, I must preface this with every single bill I can get automated; I do. Every fixed expense (those bills that are the same each month) gets auto-deducted from the account.

It saves time at the end of the month and saves fiddling around with an app or online banking.

If any irregular bills have come up, like medical, taxes, or dues, those get paid also. Some bills, such as utility bills, require an old-school check, so I ensure they are written and mailed.

I also transfer money into the appropriate savings accounts as well. I have a sinking fund savings account for my dog, car expenses, and taxes. These tend to be larger savings accounts, so it’s best to let the bank keep those safe.

Go To The Bank

Because I am a cash lifestyle follower and use cash envelopes most of the time, I like to get my cash every other Friday – enough for the entire pay period.

This way, I have money in my envelopes for everything we may need until we get paid again.

If you want to hear more about the Cash Lifestyle, check this out.

The Best Way To Pay Bills On Time

Keeping a schedule and building a habit of checking in every paycheck is the best way to keep track of your bills each month. Here are five tips to help you pay your bills on time:

Keep A List

Being financially stable is tough if you don’t know who to pay. So maintaining a list of service providers, vendors, and credit card accounts can help ensure you’re not going to miss any payments or, worse – be late on them!

It’s a good idea to keep two categories of bills: those that can be paid automatically and those that need your attention. Your list should include the lender or service provider, the minimum monthly payment, and the balance due for your upcoming bills. Once you have this information together in one place, it will make paying them more straightforward because they are easy to find when needed!

Know Your Due Date

Once you’ve got a list of bills to pay, the important part is to find out when each bill is due and add that to your list. If all the due dates for these debts are over six months apart, then it might be time to change them, so tracking payments will become easier.

You can simplify your life by setting up all of the bills you need from now on with a due date that is right after payday. This can also ensure that overspending won’t cut into any money for paying bills later in the month.

Most creditors and vendors don’t have a problem changing the due date, making batch bill pay easier. Simply give them a call and ask.

Track Bills On A Calendar

You’d be surprised how many people don’t know when their bills are due. You can keep track of bills and automatic payments through a calendar or other system, like an online bill pay system that you sync with your phone.

It might take some time initially to add payments and recurring events on the app, but it will pay off in the long run because there is less chance of unpaid fees!

You would think this was common knowledge: knowing what day your bill is due by heart – I mean, really? Surprisingly enough, there are still plenty of people out there who have not mastered paying attention to these things yet.

Tracking your bill due dates through a calendar or other system can be helpful.

Have you ever forgotten to pay one of those pesky monthly fees because it was on the same day as whatever big event that’s been capturing your attention? If so, tracking and logging every payment date for these types may be just what you need!

Decide On Payment Amount

For some of your bills, you may have to pay a set amount. Others — including credit cards and other accounts that allow you to carry a monthly balance—may allow for flexibility in payment amounts.

Ideally, the entire balance due on all your bills would be paid every billing cycle. This is not always possible, though.

For those who opt into carrying over their balances from month to month (some people do so because they are unable to, but others choose it as an option), paying more than the minimum can help save money by avoiding interest charges or reducing debt quicker through fast repayment timeframes.

Automate As Many Bills As Possible

You can make your life much easier by paying bills automatically and having the online bills taken care of by sending them to your email account instead of paper bills.

For example, when you set up a credit card to have payments taken out of your checking account on the due date every month, it will never be late again, and you won’t need to worry about filing reminders or forgetting whether or not an item is paid off.

Consider setting up automatic transfers from savings for mortgage repayments because once this is in place, there’s no more paperwork!

This works best for fixed expenses. It works for variable expenses, also, but you just need to have a closer eye on those numbers.

Armed with our list of all those pesky monthly expenses and obligations we call “bills” and, just as important, your calendar that tells us what day each one arrives (good thing my phone has both!), now it’s time to get automated!

Why Keeping Track Of Bills And Expenses Matters

It is essential to pay your bills on time. This can reduce stress, save you money, and enable you to get lower-interest credit in the future.

Doing this habitually by paying them before they are due will also make it easier for those who have a hard time budgeting their finances; when I had trouble with my finances, sometimes I forgot about what day things were due, which caused me more anxiety than necessary because I didn’t know if they were paid or not.

When you get into this habit, it will be easier to budget your time and money because when you pay bills on time, that means there is less stress in your life.

We know timely bill payments are crucial, but sometimes life gets in the way. If this has happened to you and your payment is more than 30 days late, it’s time for a wake-up call!

Not only will there be financial consequences like paying interest or collecting late fees on top of what was already owed, but these could also impact your credit score.

If we let bills pile up until they go past due dates when not even one day goes by without being paid, then getting back into good shape can seem impossible.

That said, taking care of overdue payments can be challenging while juggling all the other things in life, especially if those obligations include raising kids or taking care of a household.

What you don’t want to do is bury your head in the sand, hoping that “it all works out somehow.” The first thing to do when late bills start adding up is put yourself on a budget while paying off any late payments with an eye toward the future by building up a cash cushion. Then, you can start setting up financial goals, such as building an emergency fund or adding money to savings accounts.

Many know what it takes to get back into good standing when we fall behind on bills.

Eliminate As Many Bills As Possible By Being Debt Free

The fewer bills you have to pay each paycheck, the less you have to forget to pay or spend time thinking about it. This automatically reduces your stress level.

Being debt-free is important for those who want to decide how their money is spent instead of giving the added income in the form of interest to banks and loan companies. Imagine how it would feel to be 100% free from all debt.

We hear messages about not having debts, but in a society overrun with credit card usage and low-interest loans, does this matter?

It’s easy to see why there are so many people attracted by using credit cards as an option because they think that way they can live life like others do…but behind the facade lies many drawbacks if you’re being consumed by your desire for material goods.

Choosing what happens with our hard-earned cash seems appealing at first glance.

However, if you’re considering going into debt because of it – once you consider the hidden fees, interest costs, and temptation to spend more than you can afford – it’s always better to pay in full with cash or some other form of payment.

If you doubt this because you think that paying with a credit card is simply more manageable, think again and reconsider the baggage that comes along with it.

Final Thoughts On How To Keep Track Of Your Bills Each Month

No matter how you choose to pay your bills each month, there are a lot of benefits. As long as they’re paid on time and in full, it doesn’t matter which method is used. Whether you use a free app, a binder, or a mixture of different systems, the most important thing is having a system in place. What does matter is that you follow through with paying them on time to reap all those great personal finance benefits!

Paying your bills on time is one of the best ways to remain financially stable. The benefits include saving money, having a reliable credit history, and qualifying for mortgages or other financial products. Having good money management will help all of these, and having your bills organized will make this job that much easier.

How To Make Your Own Easy Budget Planner

How To Make Your Own Easy Budget Planner