The Revealing Truth About Dave Ramsey That You Should Know

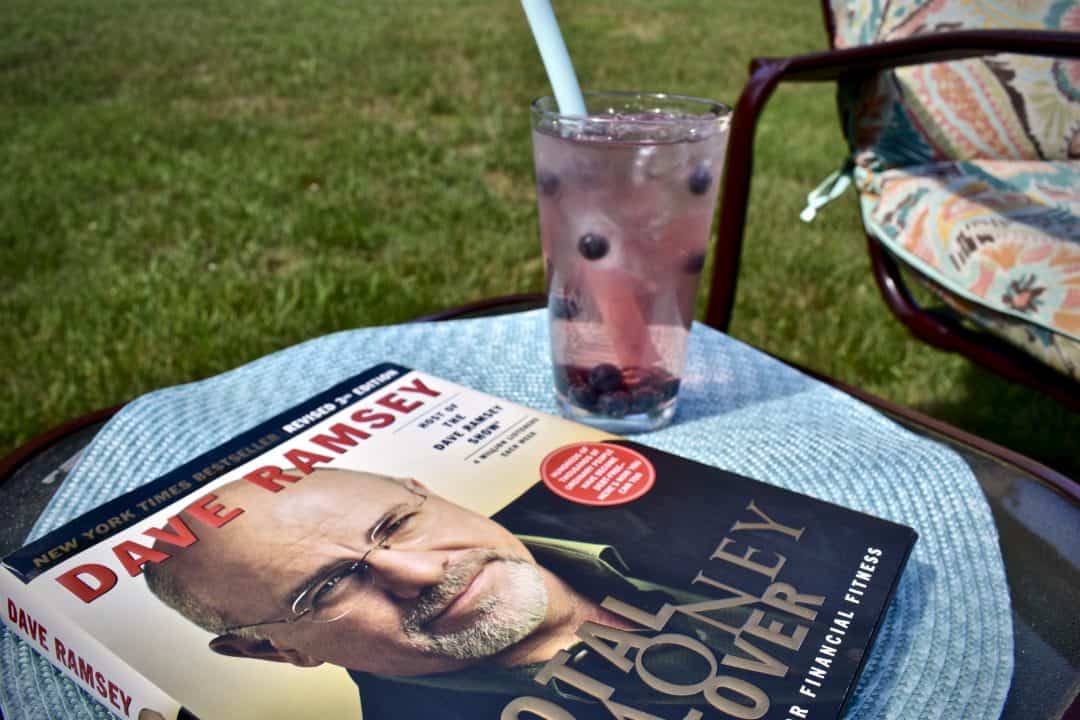

I was looking for a way to manage a bunch of rogue monkeys at the circus when I had no idea what monkeys needed. I was young and inexperienced. This book brought me hope. It was filled with a system that I understood. Here is the truth about Dave Ramsey.

Dave Ramsey is the author and founder of the company, Ramsey Solutions. They are huge. He has a LOT of money today and he has made that money by teaching people how to get out of debt by charging them money. Sounds counterproductive and even a little bit like he might be taking advantage of peoples circumstances.

Cash Is King, Still.

The first rule in business is to solve a problem. What do the people need you to fix for them? do they need sneakers to run in that will not hurt their feet? Do they need cookies that are gluten-free? Do they need a planner that is super cute and will work for their lifestyle? Or do they need a program that will end their struggles with debt? Create a product that will solve the problem.

If Financial Peace costs $100 and will teach people to eliminate thousands in debt, is it worth the money and is Dave wrong for selling the product? The book is $25 and has shown millions of people how to create a budget. That is $25 well spent, I would say.

Some have said that Dave has been wealthy for so long, he is out of touch with reality. Cash is old school and it is impossible to live that way. It is harder in today’s society when you are living paycheck to paycheck. It’s not the same as it was 25-30 years ago.

Cash, Sinking Funds, Budgets, And Emergency Funds

Social media has given us more opportunity to peek into the lives of others which may or may not give us feelings of envy, jealousy, or unworthiness. It just makes it easier to see what we don’t have and what we think others do.

Granted, as I have written about before, I do not follow the plan or Baby Steps completely but I do really love using cash, sinking funds, budgets, and emergency funds. I love the concept of being debt free and then using that money to build wealth so I can live a happy and adventurous life.

I love the idea of not owing anyone anything and being able to do what I want with my own money instead of a bank telling me how much to pay them every month.

I am not good with credit cards. I know this and I accept it. Some people are ok. They can charge their groceries or shoes and then pay it off all while earning points to fly to Las Vegas. I cannot. I am ok with this. You do you. I will do me.

Here are the 7 Baby Steps.

- Save $1,000 for a starter emergency fund as fast as possible

- Start paying off debt using the debt snowball method

- Complete your emergency fund with 3-6 months of expenses

- Invest 15%

- Save for children’s education

- Pay off your house

- Build wealth and give

If you listen to Dave on Youtube or Podcast, you might find him to be harsh and condescending to people who are not following his rules. I have found myself feeling uncomfortable with the way he has spoken to people and even hung upon them. I felt that was quite rude. His show sometimes feels like a drive-thru fast food place the way he pushes people through and the facial expressions are sometimes disturbing.

I’m not really a fan of that. But I have learned so much. Can I overcome the things I don’t care for in order to benefit so much for my return on investment?

I can see past his “my way or the highway” opinion in the way that he connects with certain callers. He is always giving away books and Financial Peace classes: always asking for callers to call him back if they need more help. But you have to follow his rule if you want to call into his game.

Dave Ramsey’s Rules

- No credit cards.

- Cash only.

- No out to eat.

- Sell everything that isn’t a necessity.

- Live well below your means.

- Knock out debt as fast as you can.

The Truth About Dave Ramsey

The truth is he isn’t for everyone. There is a strong religious underlying message here that might not work for you. He can be harsh but I am sure he won’t lie.

The truth is I think you should try it. What do you have to lose?

The truth is the stricter you are with his program, the faster the program will work for you. If you decide not to commit 100%, then it will take longer to achieve the end result that you want.

The truth is that you don’t have to follow every single rule. You can take what you need and move on from thee, adapting to fit your needs. But don’t expect the same results.

The truth is I haven’t found another book that works as well for me as this one has. And I have not been perfect. I have not followed the rules exactly and it has taken us much longer than I would have liked.

The truth is you shouldn’t follow any of this unless you are 100% in – all in. Don’t bother if you are only going to do it halfway. You won’t get the benefits unless you are intense.

The truth is…we are almost there and I owe it to Mr. Ramsey.

Great perspective! I have taken Dave’s course and read his book. Both were gifted to me, which was wonderful, because I wasn’t in a good position financially. I’m not there yet, but making progress!

I think giving this as a gift is such a wonderful idea. I got it for my son and daughter in law as a gift for their first Valentine’s Day! Just don’t stop! You got this!!

I liked and agreed with a lot of what you had to say in this post.

We read Financial Peace Revisited as part of our pre-martial counselling. I thought it was fascinating, but I definitely don’t do everything exactly the way he suggests. And while I know that will slow our progress, I’m OK with it.

As far as Dave’s approach re: interactions with people…I know there are a lot of people who don’t dig how harsh he can be and I think that’s fair. But I also tend to arrive at the same conclusion you have – he’s harsh, but I know he’s not lying. Makes me think of a conversation a co-worker and I once had about a dentist. We both went to see the same guy and she disliked him so much that she ended up switching practices. She found him too condescending and harsh; I stuck with the guy because even though he had a bit of an attitude, he was a darn good dentist. I kind of feel the same way about Dave – he can be a prickly, but he knows what he is talking about.

My stepdad was from South Carlina and he was a “my house, my rules” kind of guy. That’s the way I think of him, too. If you’re going to call into his show and ask him questions about his program, you get to listen to his advice! Some good stuff in those books and lessons!