Dave Ramsey has a debt elimination program that has given a lot of people the joy of being debt free. His simple and proven steps are foolproof if you commit and follow the plan.

Commitment is the hard part here. If you want to “live like no one else so later you can live (and give) like no one else”then you need to close your eyes, hold your breath and jump.

All in. No wading in gradually to get used to the water. You need a total emersion. It is incredible what his plan and book have done for my family.

I love to listen to his show, and I think his ideas are fantastic. I have learned a lot from him.

7 Baby Steps

- 1: $1,000 cash in a beginner emergency fund

- 2: Use the debt snowball to pay off all your debt but the house

- 3: A fully funded emergency fund of 3 to 6 months of expenses

- 4: Invest 15% of your household income into retirement

- 5: Start saving for college

- 6: Pay off your home early

- 7: Build wealth and give generously

BUT…

I do not follow Dave Ramsey’s plan exactly.

I have not followed the baby steps in perfect order. Yes, I know. You thought I was an ideal DR Follower. Meh, I am an only child, so that makes me a little rebellious and stubborn. We paid off our house before we paid off cars and student loans.

I felt it was essential to eliminate the most significant monthly payment that we had first because we were in a position to do so.

We are also not nearly as hardcore as Dave recommends. Because we are not hardcore and gazelle intense, it has taken us a LOT longer than it should have.

If I were advising you on a one on one basis, I would say to follow the steps.

As I have said before, personal finance is very private and if you want to follow the Dave Ramsey Plan, gazelle intense, here are some things you should not be doing.

If you’re going to be a little bit more relaxed about it, that is your own decision. It doesn’t mean the system won’t work just as well if you tweak it!

Get Out Of Debt

- Cut up credit cards. Yup. all of them. Don’t save one for emergencies. If you work the plan, you won’t need them. I do not have any of these.

- Pay cash, specifically for the things you tend to overspend in. Groceries, clothes, date night, Target runs. Oh, the Target runs… When it’s gone, it’s gone. All cash. All day.

- Never borrow money again. Not for a car, a boat, a camper, in addition to the house. Nope. Not even for a pool. This is my opinion and the way I want to live the rest of my life.

- Stop investing. Not forever. The theory is, if this bothers you then you will work that much harder to be out of debt to get back to the retirement savings more so. I think this is really hard and at my husband’s age, maybe not the best idea.

- Pause giving. Stop giving large gifts for birthdays or to the girl scouts. Again, not forever. I did this for a long time. I gave my time rather than my money.

- Stop shopping. Seriously. This is a big one. Stop going to the mall. Get off the computer and read a book. Unsubscribe to all those emails from your favorite stores. If you still get catalogs n the mail, call them and ask them to take you off the mailing list. Yes… spending freeze lives on!

- Have a garage sale. It is almost that time of year around here. Time to pull out all the things you don’t want, need, or have a use for and sell them in your yard. Make some money to throw at whatever you need to. Our first one is scheduled for the end of May!

- Stop going on fancy vacations. I am not saying to not get away from life for a bit but keep it super cheap. Go camping, go for the day, find a great deal. And do not do it often. One word. Camping. One more word. Cheap.

- Cut your grocery bill. This is a great place to trim the fat. I know someone who went vegan just to get out of debt. Subscribe to the blog for a free download of the introduction to the new eBook all about this exact topic!

- Turn off the cable. That is a lot of money to spend on mindless chatter and entertainment. Cancel your cable and watch most things online for free. Grab Netflix for a fraction of the cost. We had just the basic, local channels for years and then our cable company was bought out by another and we got a deal that made our package cheaper with more tv. We still rarely watch the tv.

- Stop ordering pizza. This one hurts. The whole purpose for me is so I do not have to cook. Plus, I love pizza. I have a recipe for a yummy and quick pizza dough recipe. Grocery stores also sell the crust already shaped. You just have to “decorate” it! Cheaper than delivery yet we (I) are still working on this one.

- No Amazon. At least if there are things you order because they are less expensive than anything else, put a spending limit on it and only order once a month. I have gotten much better at this, yet I find I still slip up.

- Stay out of Target. Same concept as Amazon. Once a month and a CASH limit. My new 2018 goal!!

- Stop buying to go coffees. Make it at home. Learn how to make all the fancy recipes from Pinterest or just Google it! I have cut way back on these limiting my self to only a couple Starbucks treats a month.

- Utilize the library. Some of the more significant city libraries are amazing. One close to me has a coffee shop in it! You can grab movies and books. Bring your kids in to play for a couple of hours while picking up a few great reads for your self. Especially utilize them for books you know you will only read one time. I order my books online and have them shipped to my local library. It is a great feature!

- Find free entertainment. This is harder to do in the winter where I live than the summer. When there is beautiful weather, they have all sorts of great free things to do. From Shakespeare in the park to bands every Thursday, we can always find something fun that doesn’t cost anything.

- Stay away from the movie theater. Movies are not cheap! AND then there are snacks…popcorn, soda, water, pretzels, candy… I can tell you that our theater offers half-price tickets and $5 popcorn on Tuesday.

- Do not go out to eat. Dave says to stay away from restaurants unless you are working in one. We have never followed this rule. We have always gone out on date night twice a month. But I can’t tell you the last time I went through a drive-thru at a fast food place!

Dave Ramsey

Follow Dave’s plan the way it works best for you. Take as much as you can from Dave and all other financial experts (including us blogging about money) and apply all you need to to make your life better.

You may know things need to change yet you may be hesitant to incorporate ALL advice. Do what you can and make it as intense as it needs to be for you.

This may not be the opinion of the die-hard Dave fans, and that is ok; As long as you FOLLOW a plan. Please know that it won’t work as well if you don’t follow it exactly.

I’m speaking from experience. But I don’t want you to do anything you are not comfortable doing.

Don’t follow Dave Ramsey’s plan exactly if it doesn’t work for you!

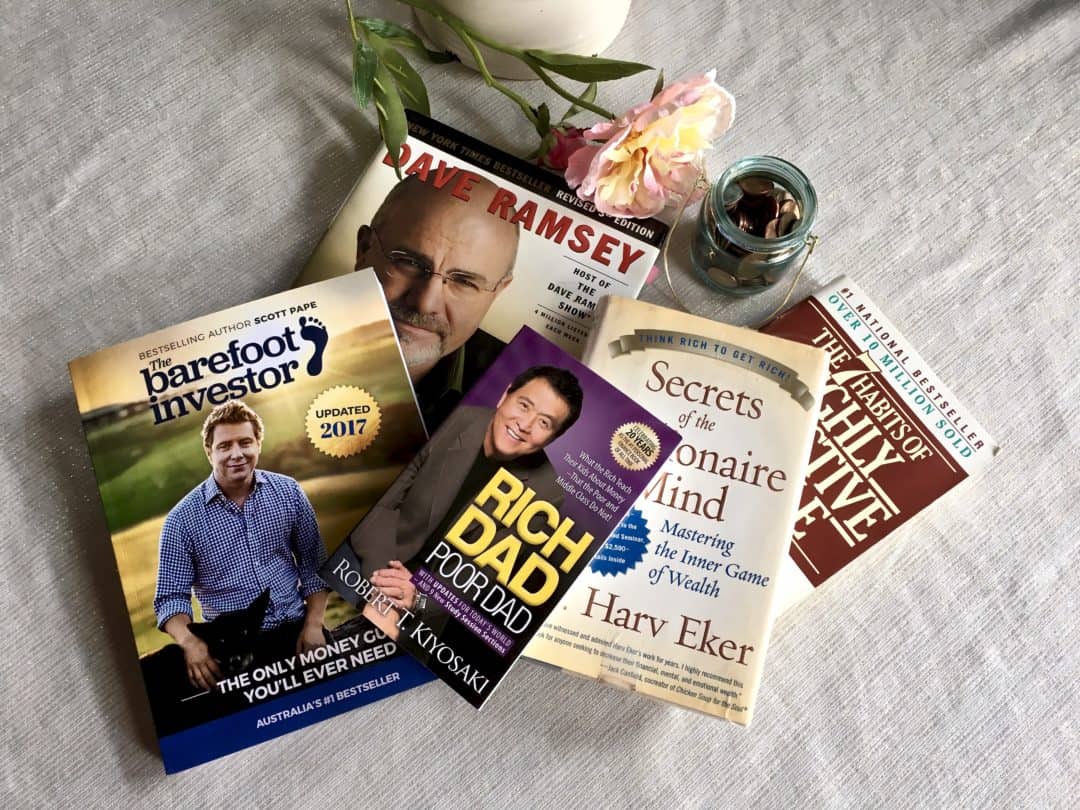

5 Best Books on Money Management

5 Best Books on Money Management

Ilana

Really great and useful article Sara! Such good tips to try!

frozenpennies

Thanks so much Ilana! Dave is the man!!

Secret Agent Woman

I also “sort of” followed Dave Ramsey’s plan. I did all the baby steps – saved an emergency fund, paid off all my debt except my house (which I’m paying down as quickly as I can), invest in my retirement and live below my means. BUT I don’t do the cash thing. I use a credit card because it gives me airline miles and I love to travel. Travel is a huge part of my life happiness. I’ve put both my kids through college and I want to travel around the world while I still can. Other than that, though, I have really reined in my spending – cut way back on eating out, and am on a no-shopping year which I intend to keep doing in one form or another when the year ends. I really do believe their is a lot of wisdom in what Ramsey has to say and also that you can modify it to fit your own personal goals.

frozenpennies

That is FANTASTIC! Good for you!! I really believe it is a very personal choice and it is ok to modify as you need to. I agree with the wisdom and I think that had I not been blessed with the gift my father left to me, I would be following the same plan. But – life happens. I love that you are traveling. It is on my bucket list very soon to head to Europe with my youngest.

Chris matt

Thank you for sharing your Dave Ramsey experience. I started the program but my wife wife and I decided it wasn’t exactly for us. We did initially get rid of our credit card, but due to multiple PCS moves and the military no long giving an advance on dislocation allowance, we decided that using a credit card for points a d paying it off works best for us. I also just signed up for your grocery ebook and look forward to reading it. Thank you!

frozenpennies

Thanks so much for your comment. Mr. Ramsey’s plan is a good one but it is flawed and just doesn’t work for everyone. I am really bad with credit cards. I know this about myself and I accept it. I hope you enjoy the book!