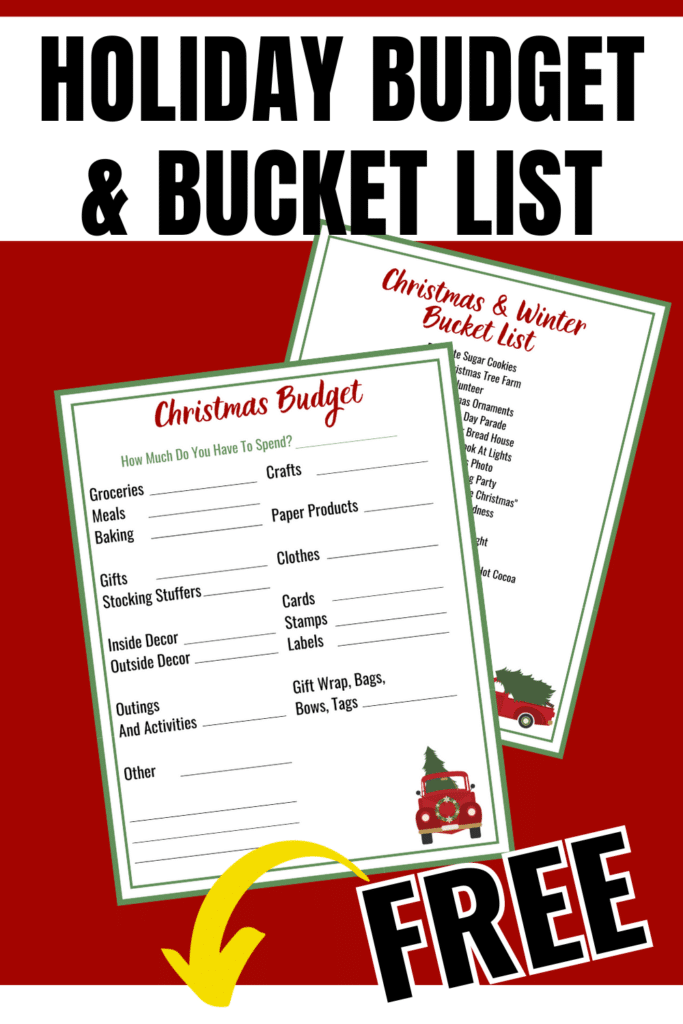

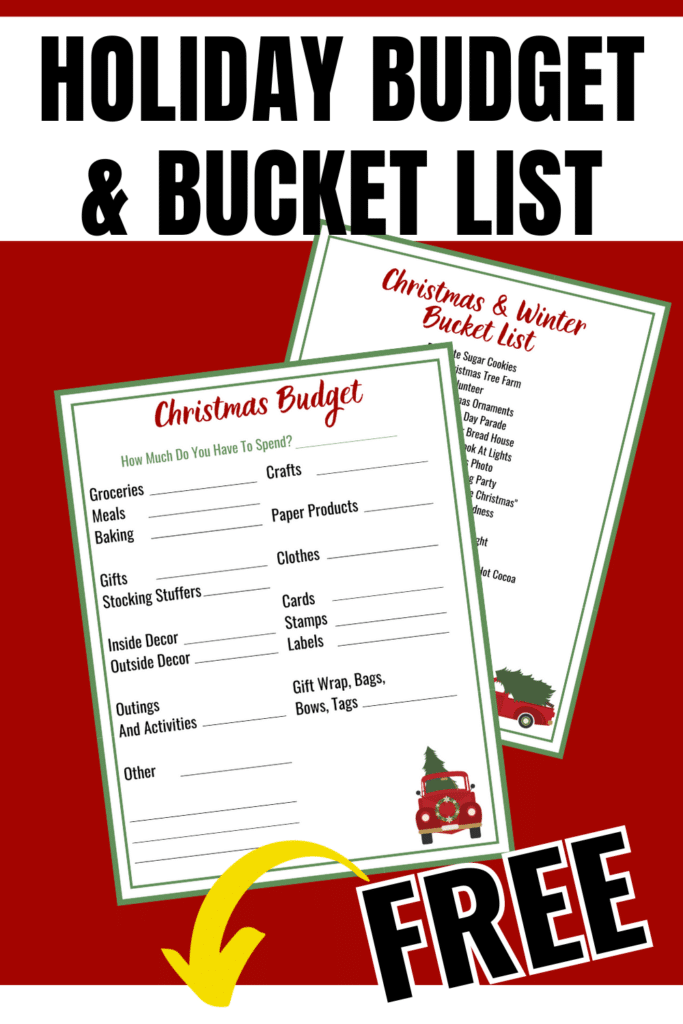

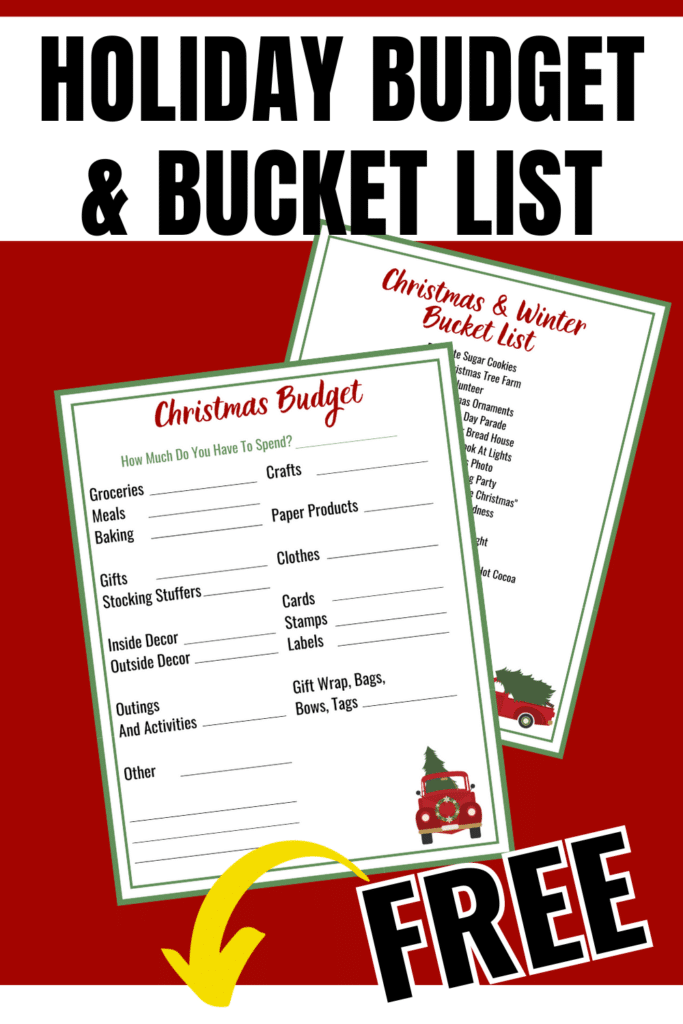

Creating a realistic Christmas budget will stop you from overspending and keep you on track for a debt-free Christmas.

Creating a realistic budget for Christmas can be done in 5 simple steps, including making lists of the people you want to buy for and all of the additional items you need for the holiday. Collecting a pool of cash from where you purchase and assigning a dollar amount to each. And finally, Once the shopping is done, do not spend any more.

Table of Contents

Why Do You Need a Realistic Christmas Budget?

Like a household budget, a Christmas budget is a plan for your money. It lets you plan for your finances and ensures you have enough for your needs.

According to CNBC, 74% of Americans said they failed to plan for Christmas financially.

The worst idea is to put the holidays on a credit card and then have to pay it off for the rest of the year. The interest you’re paying is enough to get a good jump next year if you put the same amount in a savings account.

The good news is I’ve got a plan for you! You need a budget to stay ahead of the game and not spend a ton of money. Christmas is such a stressful time of year. Why would you want to add to that?

This post may contain affiliate links. Please see the disclosure statement for more information.

5 Steps to Create a Realistic Christmas Budget.

- List all the people, friends, and family members you want to buy for.

- List all other areas that you wish to spend money on.

- Evaluate how much money you have right now to spend.

- Assign a dollar amount to each.

- Decide, based on the amount of money you have, if you need to shorten your list, decrease the amount of money, or you need to earn more.

Make a list of people you want to buy for.

Christmas presents include all extended family, immediate family, friends, and people you might forget about (see below). List them as if there were no financial barriers. Everyone that you could think of.

List all other areas that you want to spend money on.

Include all other areas. Remember to include travel, clothes, food (including Christmas dinner, brunch, munchies, and Christmas decorations.

Evaluate how much money you have right now.

If you have been saving all year, you know how much you have. If you still need to, look at your finances and see what you have in cash (without credit cards).

Assign a dollar amount to each category.

Assign a dollar amount to each person and each category based on what you think is fair and appropriate.

Decide if you need to edit the list.

When you add up all of the amounts assigned, it may or may not match up to the allocated funds. If you don’t have enough money, you have a few choices.

Cut back on expenditures, reduce amounts assigned, or find more money. Again, I strongly encourage you to avoid credit cards at all costs and only buy what you can afford to spend. Stick to what you plan to spend.

13 Things You’re Forgetting in Your Christmas Budget

Christmas Cards. Order early (or better yet, last year during after-Christmas clearance sales)

Postage and shipping. I order my stamps online as soon as they’re available. Also, remember shipping costs if you plan to send packages.

Decorations. You may only need a few new decorations if you have been doing this long enough, but consider things that fade, fall apart, or break. You may need to replace Christmas lights. Wreaths and outside decor will fade and weather through the winters. Other items break.

Gifts for Teachers. Consider practical gifts for teachers.

As sweet as mugs and teacher ornaments are things like gift cards to a grocery store, a local bakery, or Dunkin’. They can use them to make their holiday easier if they’re trying to create a realistic holiday budget.

Food. That includes all special meals: Christmas Eve, Christmas morning, brunch, lunch, dinner, and all the coffee and snacks.

Baking Supplies. Grab them all when they go on sale. Also, consider stocking up for months to come. Nuts, butter, and flour freeze well.

Gifts for Coworkers. That is not a requirement of all workplaces. But if you want to give something out to coworkers, it’s wise to plan ahead and not wait until the last minute.

Activities. There are always so many activities planned for this time of the year. If any expenses are attached to these, you’re financially ready and add them when it’s time to create your realistic Christmas budget.

Family Photos. You should do this ahead of time. So you can get the photos back and then include them in your photo cards.

Gifts for Service Workers. Many people like to give small gifts to their postal workers, garbage collectors, bus drivers, and crossing guards. Remember to plan for them, too.

Stocking Stuffers. I am surprised every year how much money I spend on stocking stuffers. Make sure you budget this as an addition to your regular gift budget.

Gifts for Friends and Neighbors. Growing up, I remember my mama and me riding around the neighborhood, giving out homemade goodies to all the neighbors each year.

It was a great memory. Times have changed a bit, and this has become a lost tradition. But, if it’s something that you still partake in, add it to your list.

Holiday Clothes and Accessories. Not only the clothes for photos but also for parties and church. Don’t forget the accessories—the belts for dress pants and the warm tights under that festive dress.

What if I Have No Money Saved for This Christmas?

On the day I write this, you have 43 days until December twenty-fifth. Let’s do a Christmas Budget Inventory! It’s always best to save ahead of time in a Christmas Sinking Fund, but if you haven’t done one before and it’s down to the wire, exploring other ideas is a high priority.

Household Budget

There is no better time to come up with a household budget. A zero-based budget will break down all the things for you.

You need to know where your money is going and your expenses today to know how much you can save in these coming weeks.

After you have a budget for your home:

- Start scaling WAY back.

- Skip the things that you do not NEED.

- Commit to a spending freeze to stockpile money.

- Decide to eat out of your pantry and only buy necessities like dairy and fresh produce.

- Dig deep into the back of that freezer.

Create Your Christmas Wish List

Let’s start with gifts for the people you love (or just like or feel obligated to buy for).

Make a list and decide on a dollar amount for each. It’s OK if you are on a tight budget. Show them the love without overspending.

Now, knowing how much money you can scrape together based on your budget, how can we lower this list? Can you bake for coworkers rather than spend $25 each? Could you find some good deals online with a value of $50 (for your Secret Santa family member)yet only costs you $35?

How about getting a small Christmas gift for your niece and a printout of a promised trip to the aquarium in the cold winter months? Experiences are a great gift for kids and can be your love language.

Consider the five gift rule for children. That is what we do for our niece, nephew, and granddaughter.

Prioritize Traditions and Fun

You don’t have to do all the things this year. Set priorities.

What are your top three favorite traditions that require money? Can you do those and find alternative (and free) things to do instead?

Also, consider how you can still carry out these traditions but tweak them to cost less. Remember why you love the specific tradition the best.

If your favorite part of the holiday is your annual Christmas party, why not make it four different appetizers instead of a buffet dinner? Or consider serving a signature punch instead of wine, beers, and mixed drinks.

Some tremendous cheap Christmas traditions can be so fun for anyone – kids, adults, families, and singles.

Try Alternative Gift Giving

Consider picking names out of a hat for next year, secret Santa, or White Elephant gift exchanges instead of buying for everyone in the family. In our extended family, we have done a few of these in the past year or two. We’ve decided to forgo the gifts and have a nice meal together, keeping the holiday spending minimal. We used to just buy for the little kids, but now that they are older, we thought it was a good idea to skip it altogether.

Earn Extra Money

After you have looked at your household income, made your lists, and realized your money is insufficient, it’s time to get intense and make some money fast.

- My good friend Kim sells pumpkin rolls for Thanksgiving. She buys baking supplies in bulk and sells them for $15 each. The pumpkin roll sales give her enough money for her Christmas gifts, and everyone loves homemade gifts from the kitchen.

- Retail stores are hiring for the holidays. That can give you a few hundred dollars in a month working part-time.

- There are always date nights and Christmas parties. Consider babysitting on the weekends in the evenings. Babysitters make GOOD MONEY!

- For more ideas on how to make an extra $300, check out this article.

Make What You Can

If you’re crafty, make some Christmas gifts. Custom t-shirts are a great gift idea. If you have a vinyl cutting machine or know a friend who does, grabbing a $5 t-shirt from the craft store and making Gramma a custom t-shirt is a sweet and cheap gift.

Bake for friends, neighbors, and coworkers. I have been doing this for years. I make these cute quick breads. Sometimes, I pair it with maple butter or a sample coffee. I paired it with a custom Christmas CD I made one Christmas.

If you have a sewing machine, try sewing some pretty pillowcases. They are straightforward, straight-line stitches. And a patterned pillowcase looks so lovely with a solid set of sheets. Let’s face it: sheet sets never come with enough pillowcases.

How to Save All Year for Christmas

I understand the thought of Christmas all year round is a downer for so many. The stress of the season has depleted the love for the season. What if you could plan and take away all that stress?

Having a Holiday Planner has saved me over the years. It’s the one place where everything Christmas lives.

Create a Budget.

It sounds like a broken record, but repetition is the most significant learning method. So, having a budget lets you plan for the most important things.

Christmas comes at the same time every year. We know it’s coming.

Set Up a Sinking Fund.

Plan and start a mini savings account just for Christmas.

Because I use the budget-by-paycheck method, I save money for Christmas all year. I set aside $50 per paycheck ($100 monthly) specifically for Christmas in a sinking fund.

Having an account earmarked for Christmas with a debit card attached is a great idea. Because so many people shop online, having a dedicated account and card makes for simple shopping.

Start saving for next year now.

Consider Using Your Tax Return.

I understand that many people get their tax returns in the spring, but consider taking that money and saving it for the following Christmas.

It might be hard for some to hold on to that money for so long, so putting it in an online account where it’s out of sight and out of mind is a great idea.

Sell Stuff in the Fall.

Doing a fall declutter to make money for Christmas is another option.

Buy All Year Round.

- Hitting the after-Christmas sales for your gift wrap, bows, gift bags, and cards will save so much money. Most stores mark this stuff up to 70% off – or even more.

- I am earning gift cards through apps like Ibotta or online earning and coupon sites like Rakuten and saving them for Christmas.

- Consider picking up gifts for people all year round. Start your Christmas shopping early. Seeing something that your mama would love on clearance at Kohl’s and then writing her name on it and putting it away will help with the exhausting hustle and that clearance price tag.

- I pick up gift cards weekly (or month) throughout the year: $5 Dunkin’ here, $25 Target there. They can be used to give as is or to spend on those gifts.

Consider Deals And Black Friday.

Look for things with tags still on them from the thrift store. Keep an eye on clearance and sale items. Look for deals on black Friday and the days surrounding it (as not all the best deals happen on BF). This is also a great time to invest in an artificial tree rather than spending yearly money on a real tree.

Final Thoughts on How to Create a Realistic Christmas Budget

With all the excitement of the holiday season, it’s effortless to overextend ourselves and overspend our money. But having a realistic Christmas budget allows you to buy everyone you love something special without the guilt of not having the money.

The one key is not going above the assigned Christmas spending plan or buying gifts you can’t afford.

Remember, it’s all about spending quality time with the ones you love. Christmas time is a great way to catch up with those you haven’t seen in a while and celebrate those you see often. You don’t need expensive gifts and go into credit card debt with an overabundance of Christmas expenses.

The last thing you want to do is get those credit card statements in the mail come January first and wonder how you fell into such a deep hole. Start where you are.

20 Cheap Graduation Party Food Ideas on a Budget

20 Cheap Graduation Party Food Ideas on a Budget